Qualifying for a mortgage has never been a breeze and it’s about to get much harder.

In mid-October, the federal government announced changes to mortgage qualification rules and a more stringent “stress test” for uninsured mortgages for those with a 20 per cent or higher down payment.

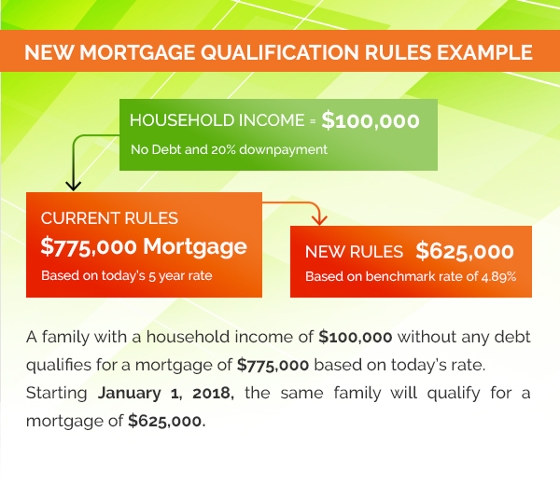

The biggest impact these changes will have is on purchasing power and housing affordability. Rate Hub, a rate comparison website, looked at two different financial scenarios to compared what a family could afford to buy before and after the new rules.

Before the changes, a buyer could borrow roughly the equivalent of seven times their yearly income. With the new rules, that has been reduced to slightly more than five times their yearly income.

In practice, the new rules means that homebuyers have had their buying power slashed by about 20 per cent.

The latest stress test comes after several other rule changes this year in the real estate market that have been met with equal criticism. Earlier this fall, borrowers with less than 20 per cent down payments were affected and, now, the focus has turned to those with 20 per cent or more down payment.

The idea, regulators explain, is to help protect banks and ensure that everyone – no matter how much money they’ve initially put down – have to undergo a stress test before borrowing.

Banks are competitive and, to drive business, do not want to offer below-market rates and mortgages if other banks are doing so. By making it a federal regulation, it means that all banks have to be on board – levelling the playing field and reducing risks from uninsured mortgages all around.

For homebuyers, however, it means that some properties are now out of financial reach which brings up all sorts of issues of housing affordability because people will no longer qualify to borrow as much money as previously.

Experts say that the new measure will hit the real estate market like a sledgehammer by driving down prices. Others believe it is a good change and will equalize the market over time.

The changes come into effect on January 1, 2018.