First-time homebuyers have something to look forward to in the new 2019 federal budget: Canada's housing agency is offering to pitch in towards the purchase price.

Exact details of how this "shared equity mortgage” will work still need to be hashed out by the government and are expected to be released in the fall.

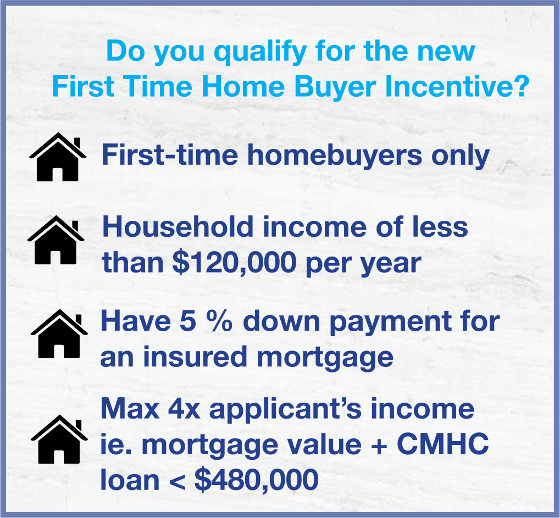

In the meantime, this is what we know so far about the new incentive:

The First Time Home Buyer Incentive is a measure to help with housing affordability and lower the amount of money Canadians pay.

Under the program, the Canada Mortgage and Housing Corporation (CMHC) contributes up to 10 per cent of the purchase price of a home. This brings down the mortgage load for borrowers.

In exchange, the CMHC gets a 10 per cent stake in the house — which is why it’s described as a “"shared equity mortgage."

For example, let’s say a homebuyer is purchasing a $400,000 property. Under both the old and the new rules, they need at least a $20,000 down payment — five per cent of the price.

So that means they would usually need to borrow the remaining $380,000 as a mortgage.

Under the new program, the CMHC would contribute 10 per cent and so throw in an additional $40,000 at the time of purchase. That means the buyer only needs to take out a $340,000 mortgage – which leads to savings over month-to-month payments.

Homebuyers pay back the money to the CMHC when they sell the house (or sooner, if they want).

Comments:

Post Your Comment: